Bring Excellency With Our Expertise

The dashboard is built to provide merchants with imperative data to their business's payment processing and related items, such as fraud prevention, added-value analytics, support assistance, and more.

Our dashboard is broken down into six main segments: Home, Reporting, Tools, Insights, Support and Bizlitix.

The dashboard is built to provide merchants with imperative data to their business’s payment processing and related items, such as fraud prevention, added-value analytics, support assistance, and more.

home

The home page provides a profile of your business with ability to toggle legal entities or DBAs (when applicable). It also shows merchant ID info, tickets, PCI compliance, and other high- level information.

support

Open a support ticket, make account changes, view our how-to knowledgebase or easily pull customer support contact information.

Customer support at your fingertips…

Tools

The insights section contains relevant news, tips, and key product information. Keep informed with industry news and dashboard enhancements.

Insights

We have included helpful tools; such as, a fraud analysis page which provides businesses with up-to-date and historical transactional data tailored towards risk analysis.

Reporting

Offers accurate and up-to-date information about transactions processed by your business. This includes authorizations and batches with numerous

altering options, chargeback management tools, statements and reserve balance for high-risk merchants.

Make your accounting easy and seamless…

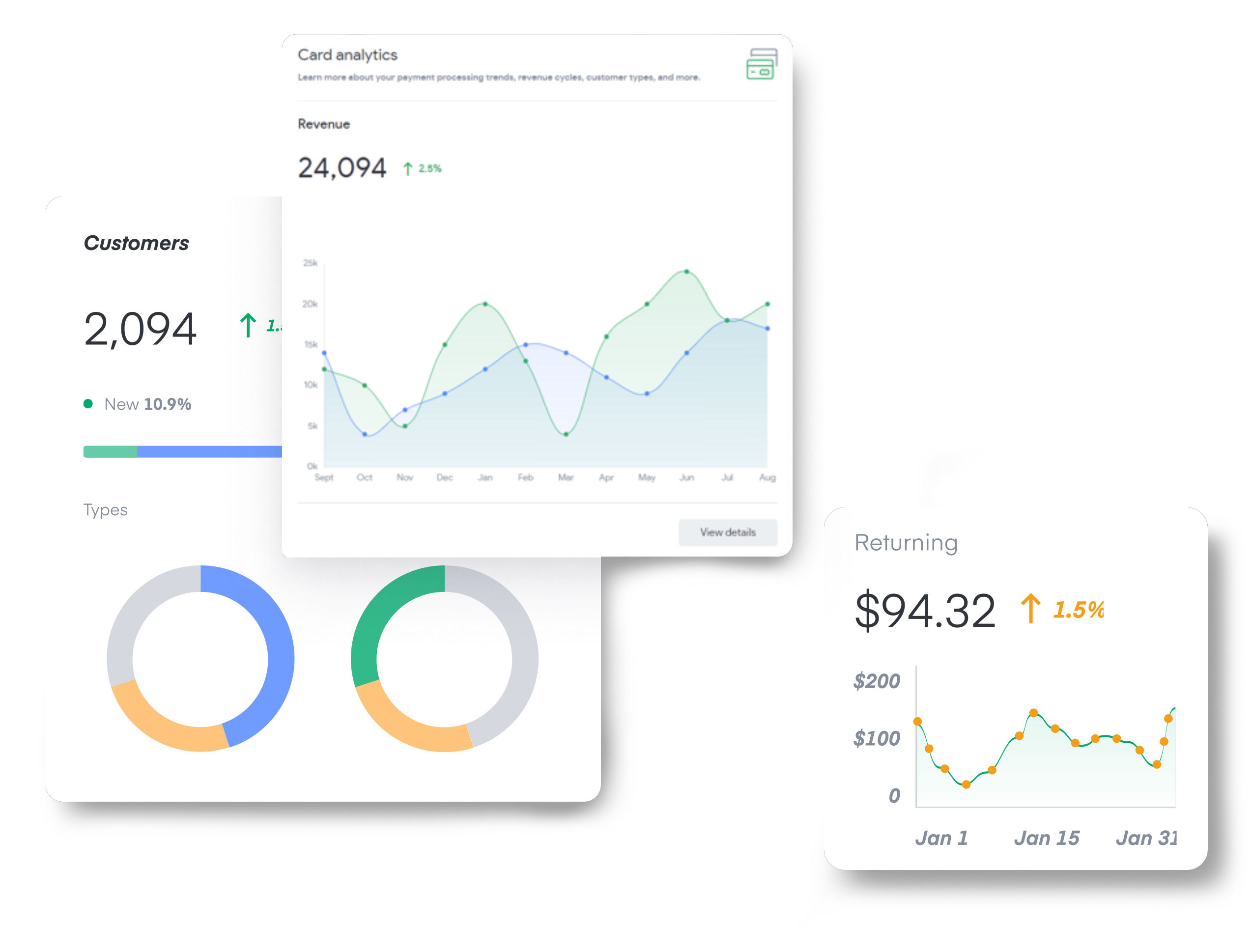

bizlitix

The Bizlitix section has many features including card analytics, website analytics, reputation management, market intelligence, product analytics, page speed insights, keyword research, competitor insights, heat maps, site audit and local competition.

When applicable, you can also compare multiple reports or track changes over a custom time frame. This allows you to review performance and map information trends.

Payment Gateway

Credit Card & ACH

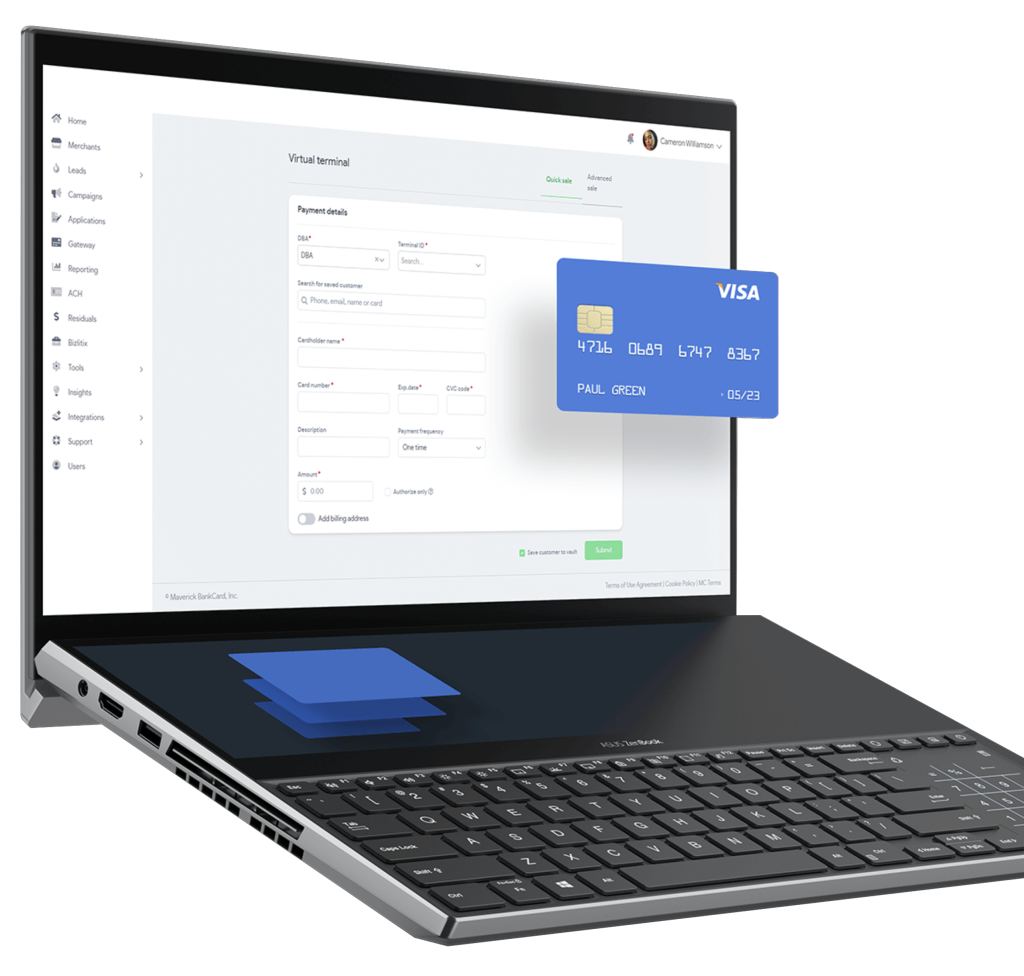

Virtual Terminal

Simply key in payment details within the dashboard to charge customers.

Hosted Forms

Securely process payments Using payment forms hosted within our environment for a reduced PCI scope.

Tokenization

Store card data for recurring customers without worrying about handling sensitive card data.

Card Authentication

Authenticate a card’s validity prior to any type of payment.

Limited Acceptance

(BIN-based debit or credit blocking): Block specific card types to ensure compliance, mitigate fraud, etc.

Recurring Payments

Easily charge customers recurring payments with different scheduling periods.

Automated Interchange Optimization

Save relevant information required to qualify for interchange savings of over 20%; facilitating an automated experience.

Fraud Tools

(AVS, CVV & IP): & Prevent fraud with the flexibility of blocking transactions based on different AVS and CVV criteria. Additionally, track IPs when available to have more insight on customer location.

ENHANCED FEATURES*

3DS

Eliminate fraud and lower interchange by utilizing 3-D Secure as an additional layer of protection when processing card-absent transactions.

Account Updated

Automatically update cards when a customer’s payment information is expired or replaced to achieve a seamless customer experience.

*May have additional costs